Getting funds like a loan or investor funds to start up or operate your business is one of the most challenging tasks a small business owner will deal with.

Whenever establishing your own business you might be able to utilize your personal savings, or you may obtain some money from friends and family. Nonetheless, there’ll come a time that you might need to go out of your immediate circle and enter the business finance arena to get a small business loan.

In order to lessen the complexity in acquiring finances, you should take the important steps to prepare for a small business loan. It is crucial to learn other options and various other business finance products and alternatives and know how to seal the loan deal.

Considering the fact that banks look at small quick working capital business loans risky, you must look into other business finance options and also be well prepared before you approach your loan officer.

Listed below are the 5 issues the bank will consider whenever you apply for a small business loan.

Your Personal Credit History

Being a small business owner you have to always remember that your personal credit history takes on a crucial role in your ability to attract financing for your business. Prior to banks as well as other financial institutions will provide you cash, they will look closely at your credit history and credit standing.

How Much Money Do You Really Need?

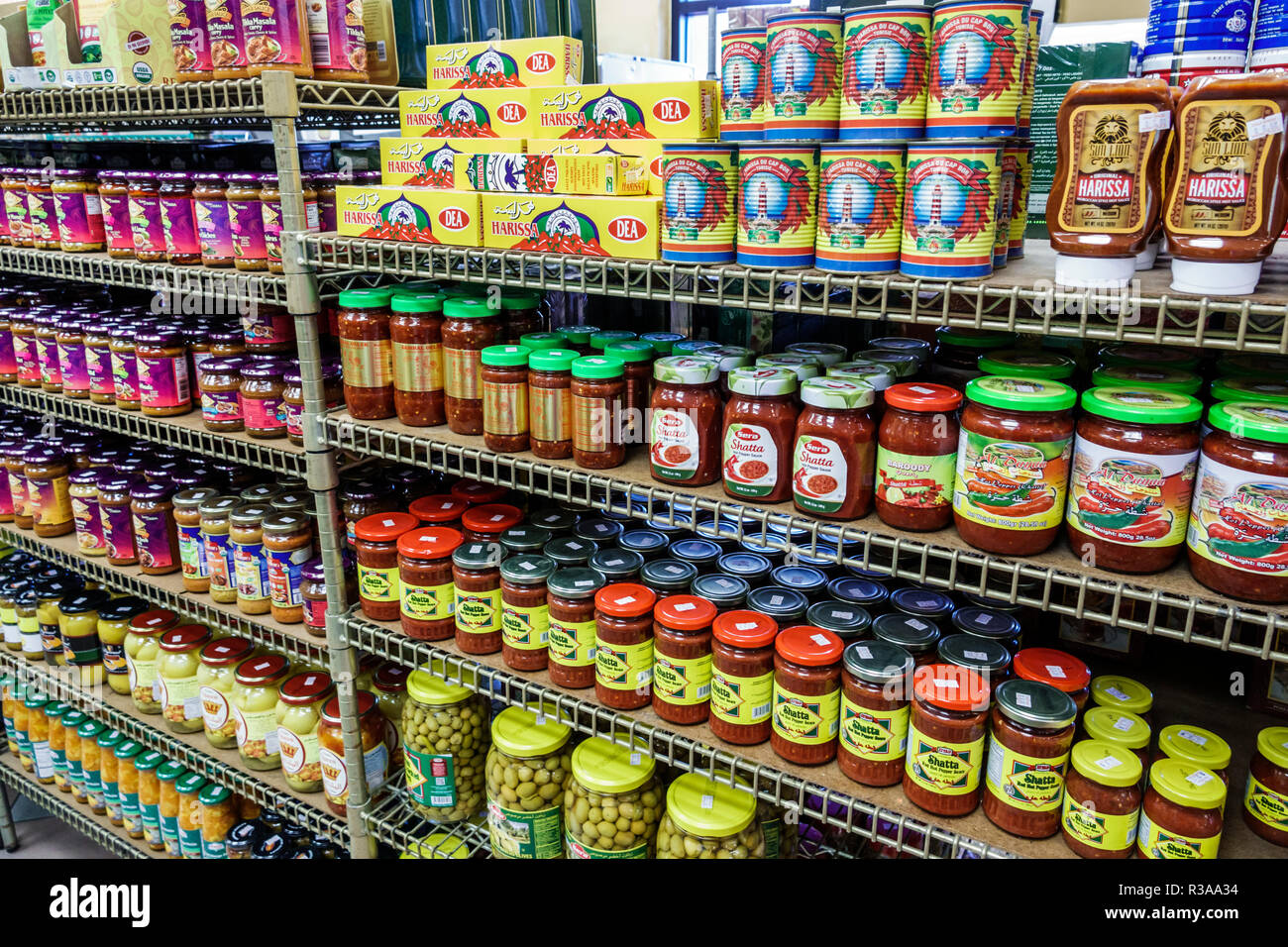

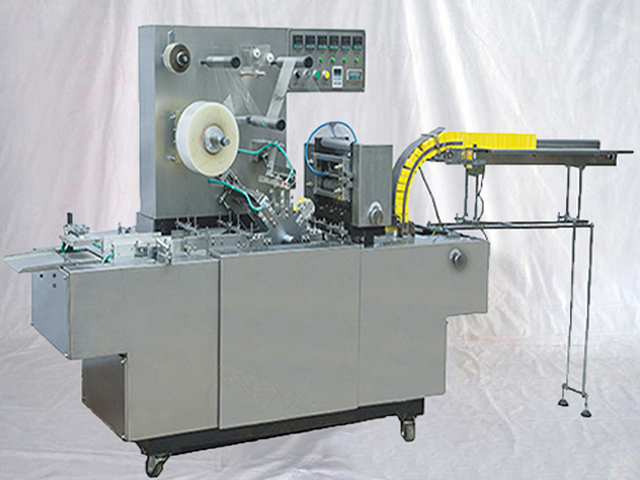

Next, you have to estimate how much money you will require to run your business. You need to estimate the amount you need for inventory, payroll, manufacturing expenses, supplies, real estate and miscellaneous assets. You need to be exact in your estimation to be able to obtain sufficient money to invest wisely.

Good Business Plan

Preparing a business plan is the most important task to get a small business loan. The business plan must inform the lending company what the business is, why it is feasible in your area, and must answer the questions a loan company would ask. To build a business plan you need to do some investigation or you may give some thought to using the services of a planner or an accountant to help you out.

The Profitability Of Your Business

You ought to be able to convince your loan officer that your business will be flourishing and that you’ll settle the small business loan timely. For this task you must use your forecasted financial statements.

What Will You Do If Perhaps Your Loan Isn’t Approved?

This is one of the last questions that the loan officer will likely ask you. Always be well prepared to have an excellent answer for this question. Let lenders know that you’ll try other lenders and programs which will cater your needs and that being rejected will not prevent you from starting and improving your business.

Bear in mind that you may have to try a lot of loan creditors before you become successful in obtaining a small business loan. Be confident and optimistic; don’t get disheartened as you can for sure discover one that will grant the loan you need!

![Building Brilliance: Unveiling the Premier Residential Construction Experts in [Your City]](https://readingcoremag.net/wp-content/uploads/2023/12/Depositphotos_26374913_m-2015.jpg)

0