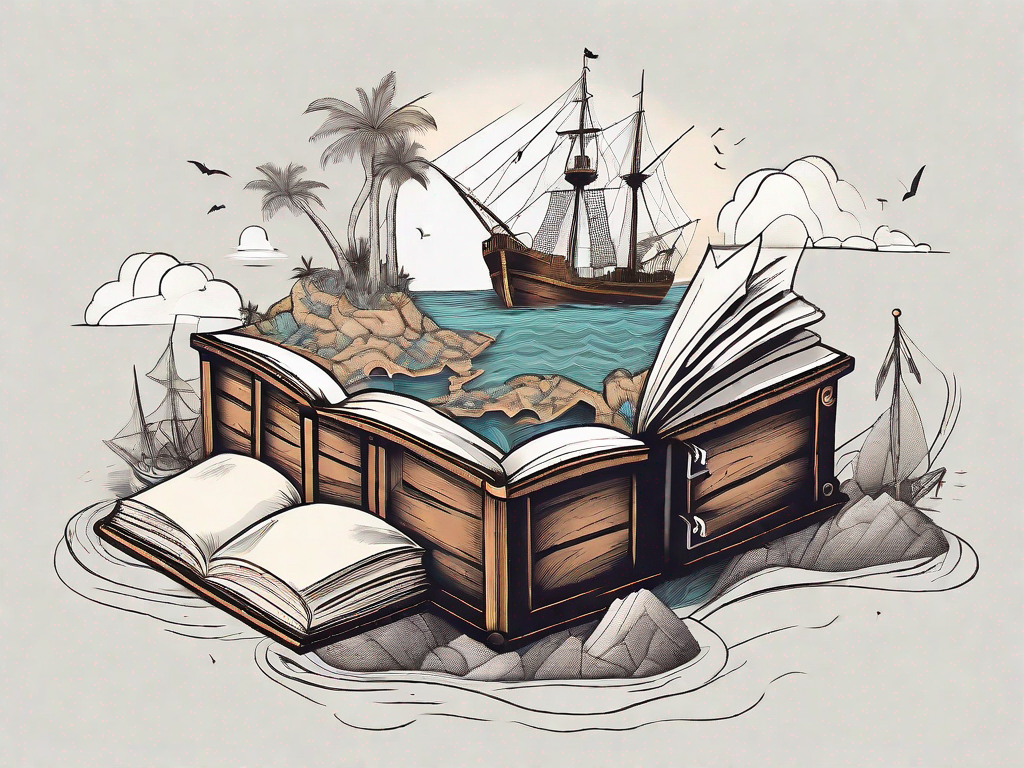

Embarking on the journey of real estate investment is not merely about acquiring properties; it’s a strategic venture that holds the potential for substantial financial growth. “Profitable Ventures: A Guide to Real Estate Investment” serves as a comprehensive roadmap, providing insights and strategies to navigate the dynamic landscape of real estate and unlock the doors to lucrative opportunities.

- Define Your Objectives: The first step in any profitable venture is clarity of purpose. Define your investment objectives—whether it’s long-term wealth accumulation, passive income generation, or strategic portfolio diversification. Knowing your goals will guide your decisions and shape your investment strategy.

- Market Research and Analysis: Successful real estate investment begins with thorough market research. Analyze local and regional market trends, Villas for Sale in Dubai property values, and economic indicators. Identifying emerging opportunities and understanding potential risks are crucial aspects of making informed investment decisions.

- Financial Planning: Crafting a sound financial plan is essential for successful real estate investment. Determine your budget, evaluate financing options, and establish a clear understanding of the potential returns on investment. A well-thought-out financial plan is the foundation for building a profitable real estate portfolio.

- Property Selection: The art of profitable ventures in real estate lies in property selection. Identify properties with the potential for appreciation and steady rental income. Consider factors such as location, neighborhood development, and property condition. Diversifying your portfolio with a mix of property types can enhance overall profitability.

- Risk Management: Real estate, like any investment, carries inherent risks. Mitigate these risks by conducting thorough due diligence. Assess property condition, potential for market appreciation, and any legal or regulatory considerations. A proactive approach to risk management safeguards your investments and ensures long-term profitability.

- Strategic Financing: Explore financing options to maximize your investment potential. Whether through traditional mortgages, partnerships, or creative financing methods, strategic financial arrangements can amplify your purchasing power and optimize returns on investment.

- Active Property Management: Profitable ventures in real estate require diligent property management. From routine maintenance to tenant relations, actively managing your properties ensures that they remain attractive, well-maintained, and consistently generate income. A well-managed property portfolio is a key to sustained profitability.

- Stay Informed and Adaptive: The real estate market is dynamic and subject to changes in economic conditions, regulations, and consumer preferences. Staying informed about market trends and being adaptive to evolving circumstances ensures that your investment strategy remains relevant and profitable over time.

“Profitable Ventures: A Guide to Real Estate Investment” is more than a guidebook; it’s a strategic companion for those looking to transform real estate investment into a lucrative venture. By defining objectives, conducting thorough research, planning financially, selecting properties wisely, managing risks, adopting strategic financing, maintaining active property management, and staying informed, investors can embark on a journey of profitable real estate ventures with confidence and foresight.

![Building Brilliance: Unveiling the Premier Residential Construction Experts in [Your City]](https://readingcoremag.net/wp-content/uploads/2023/12/Depositphotos_26374913_m-2015.jpg)

0