Investing in vacation properties presents a unique opportunity for individuals seeking to diversify their Sell landed Property Singapore portfolios and capitalize on the lucrative vacation rental market. Whether it’s a beachfront condo, mountain cabin, or lakeside retreat, vacation properties offer the potential for rental income, capital appreciation, and personal enjoyment. In this comprehensive guide, we’ll explore the benefits, challenges, and key considerations of investing in vacation properties to help you make informed investment decisions.

Benefits of Investing in Vacation Properties

Rental Income Potential

Vacation properties can generate substantial Sell landed Property Singapore income, particularly in popular tourist destinations and high-demand travel seasons. Short-term vacation rentals often command higher rental rates than traditional long-term leases, allowing investors to maximize cash flow and achieve attractive returns on investment.

Personal Use and Enjoyment

Investing in a vacation property provides the opportunity to enjoy memorable vacations with family and friends while generating rental income during periods of vacancy. Owners can use the property for personal getaways, family reunions, or holiday retreats, creating cherished memories and experiences for years to come.

Diversification of Investment Portfolio

Vacation properties offer diversification benefits for Sell landed Property Singapore investors seeking to spread their risk across different asset classes and geographic locations. By adding a vacation property to their investment portfolio, investors can hedge against market fluctuations and economic downturns, potentially enhancing overall portfolio performance.

Challenges of Investing in Vacation Properties

Seasonal Demand and Vacancy Risks

Vacation properties are subject to seasonal demand fluctuations, with peak rental periods during tourist seasons and low occupancy rates during off-peak months. Owners may experience challenges in filling vacancies and generating consistent rental income throughout the year, particularly in destinations with limited tourist appeal.

Property Management and Maintenance

Managing a vacation rental property requires ongoing maintenance, cleaning, and guest services to ensure a positive guest experience and maintain property value. Owners must either invest time and effort into self-managing the property or hire professional property management services, which can eat into rental income and reduce profitability.

Regulatory Compliance and Legal Considerations

Vacation rental properties are subject to various regulatory requirements, zoning ordinances, and homeowners’ association rules that govern short-term rental operations. Owners must ensure compliance with local regulations, obtain necessary permits and licenses, and address legal liabilities associated with hosting guests on their property.

Key Considerations for Investing in Vacation Properties

Location Selection

Choosing the right location is paramount when investing in vacation properties. Consider factors such as proximity to tourist attractions, accessibility, demand trends, and regulatory environment. Conduct thorough market research and due diligence to identify high-growth potential markets and desirable vacation destinations.

Financial Analysis

Perform a comprehensive financial analysis to assess the potential return on investment (ROI) of a vacation property. Evaluate factors such as purchase price, rental income projections, operating expenses, financing costs, and expected appreciation. Calculate key financial metrics, such as cash-on-cash return, cap rate, and net present value (NPV), to determine the viability of the investment.

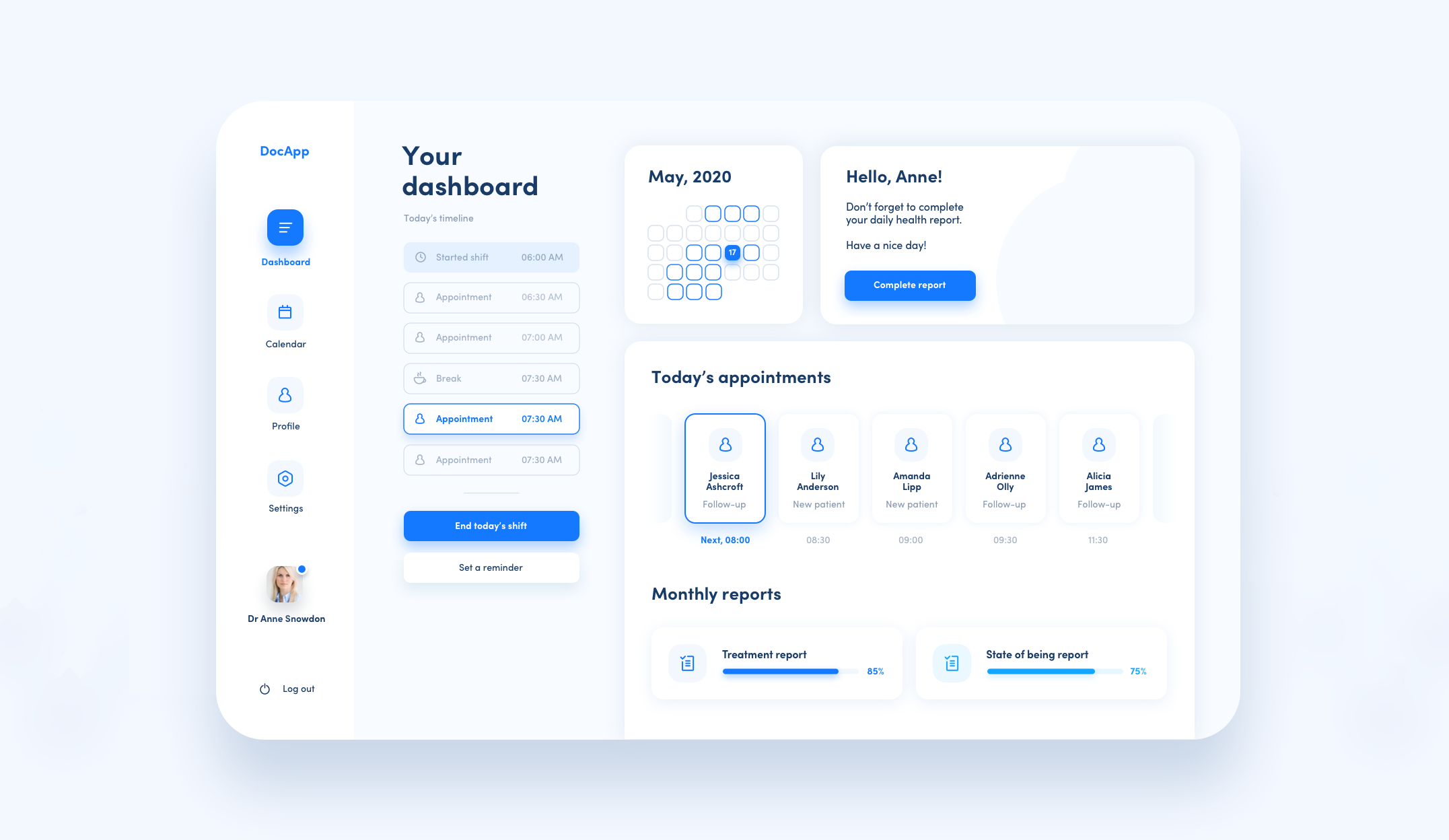

Property Management Strategy

Develop a sound property management strategy to maximize rental income and minimize operational expenses. Decide whether to self-manage the property or enlist the services of a professional property management company. Establish clear policies and procedures for guest communication, bookings, check-in/out, maintenance, and emergency response.

Conclusion

Investing in vacation properties offers a compelling opportunity for individuals seeking to diversify their Sell landed Property Singapore portfolios and capitalize on the growing demand for short-term rentals. By understanding the benefits, challenges, and key considerations of vacation property investment, investors can make informed decisions to achieve their financial goals and create lasting memories for themselves and their guests.

![Building Brilliance: Unveiling the Premier Residential Construction Experts in [Your City]](https://readingcoremag.net/wp-content/uploads/2023/12/Depositphotos_26374913_m-2015.jpg)

0