Food entrepreneurs, from farmers and food producers to restaurant owners and caterers, play a vital role in providing quality food products and culinary experiences to consumers. However, the food industry can be highly competitive and capital-intensive. Business Capital tailored to food entrepreneurs are essential in helping them navigate the challenges and opportunities of bringing their culinary visions from farm to table. Here’s how these loans empower food entrepreneurs:

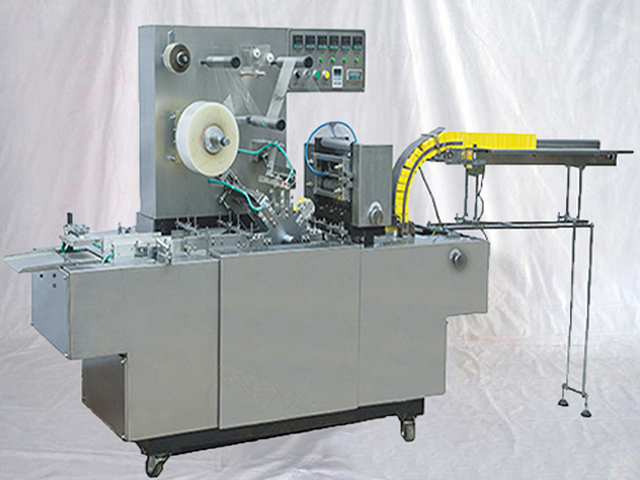

1. Farm and Equipment Financing:

- For farmers, loans can fund land acquisition, equipment purchases, and infrastructure development. This ensures efficient farming operations and quality produce.

2. Seasonal Working Capital:

- Seasonal businesses like farmers’ markets and ice cream shops often require working capital to cover expenses during off-peak periods. Loans can provide the necessary funds to bridge these gaps.

3. Restaurant Startup Capital:

- Aspiring restaurant owners can use loans to cover startup costs, including leasehold improvements, kitchen equipment, and initial inventory.

4. Expanding Product Lines:

- Food producers and artisans can access capital to expand their product lines, create new recipes, and invest in R&D to meet evolving consumer demands.

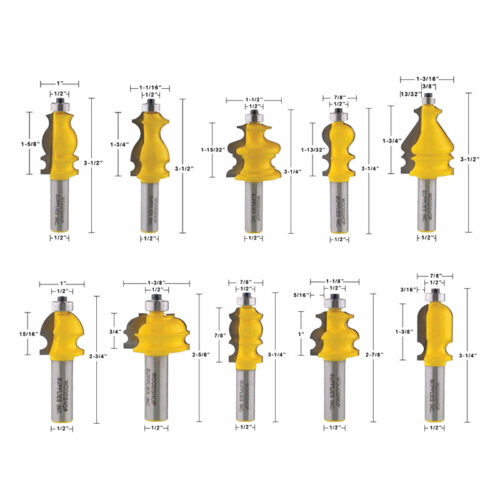

5. Kitchen Renovations:

- Restaurant owners and caterers may need loans to renovate their kitchens, improve efficiency, and ensure food safety compliance.

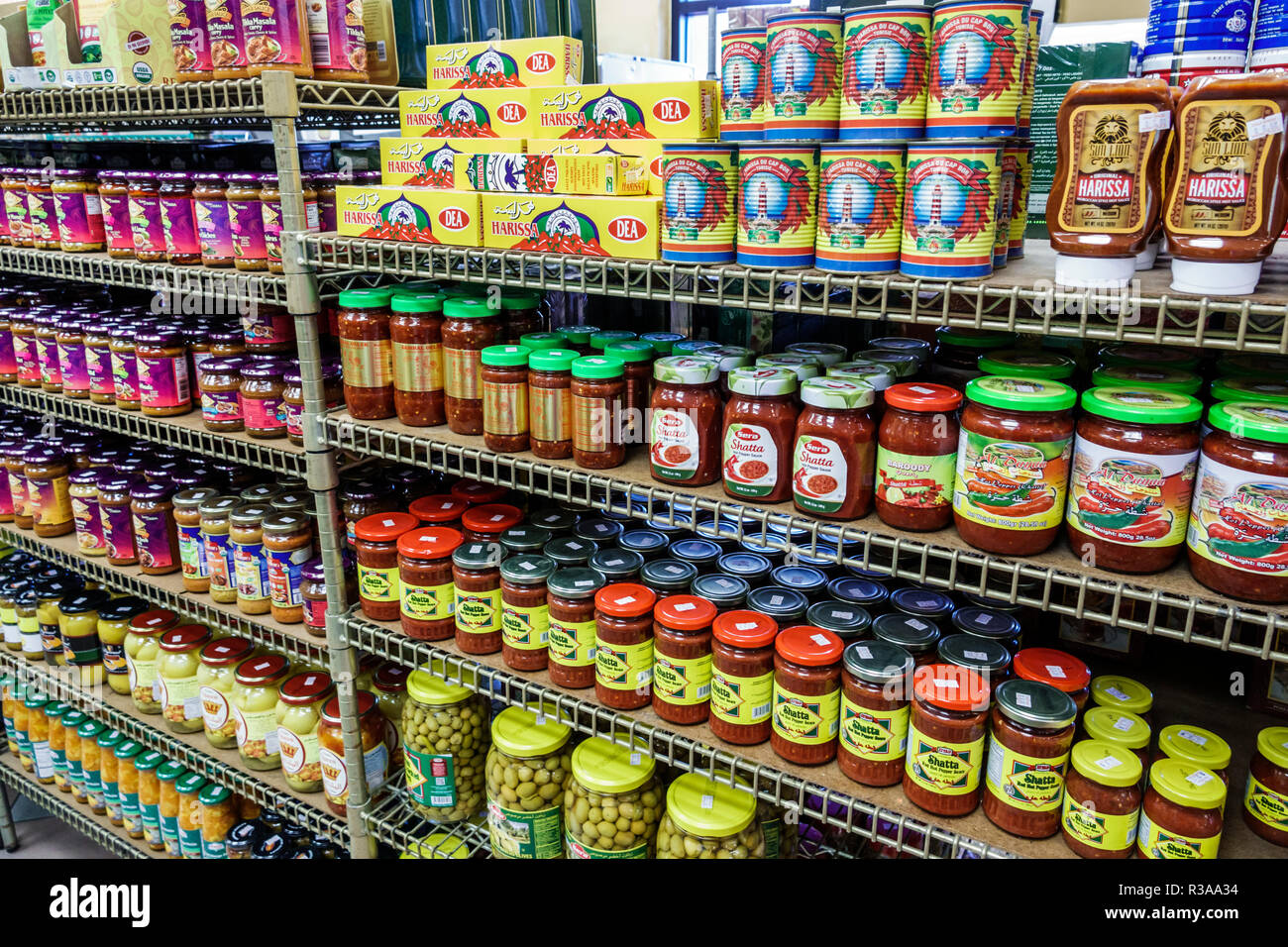

6. Inventory Financing:

- Loans can be used to purchase inventory, ingredients, and raw materials, ensuring that food businesses have a consistent supply to meet customer demand.

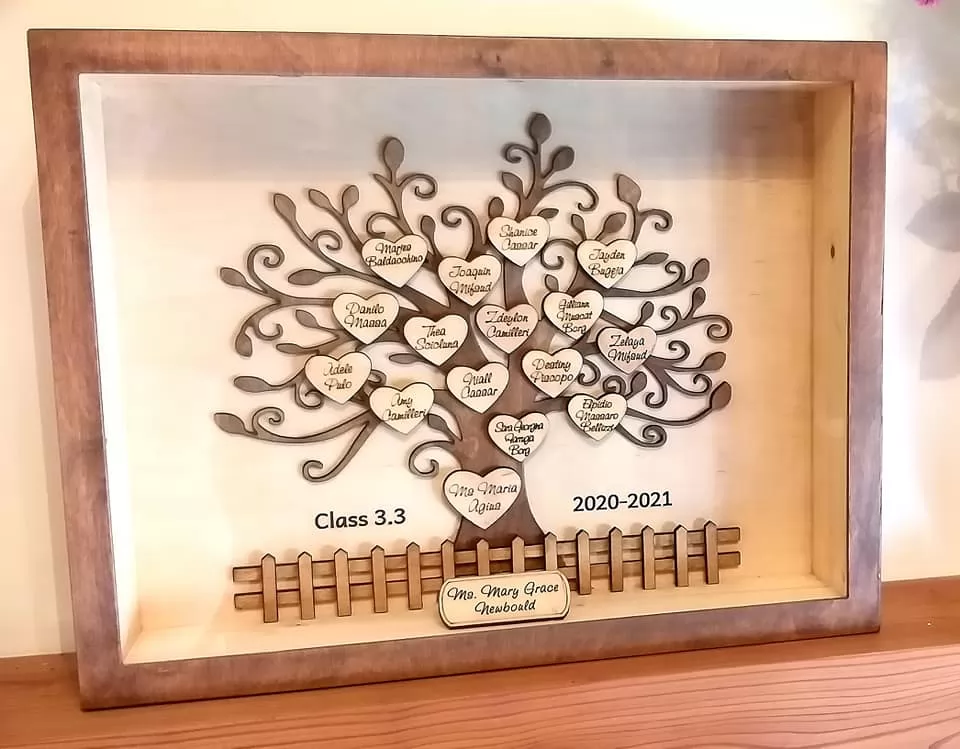

7. Marketing and Branding:

- Building a strong brand and effective marketing are crucial for success in the food industry. Loans can fund marketing campaigns, packaging design, and promotional events.

8. Food Safety and Quality Certification:

- Meeting food safety and quality standards is paramount. Loans can support the attainment of certifications like USDA Organic, Non-GMO Project Verified, or others.

9. Expansion and Franchising:

- Successful food entrepreneurs often seek to expand their operations or franchise their concepts. Loans can facilitate expansion into new locations or the development of franchise systems.

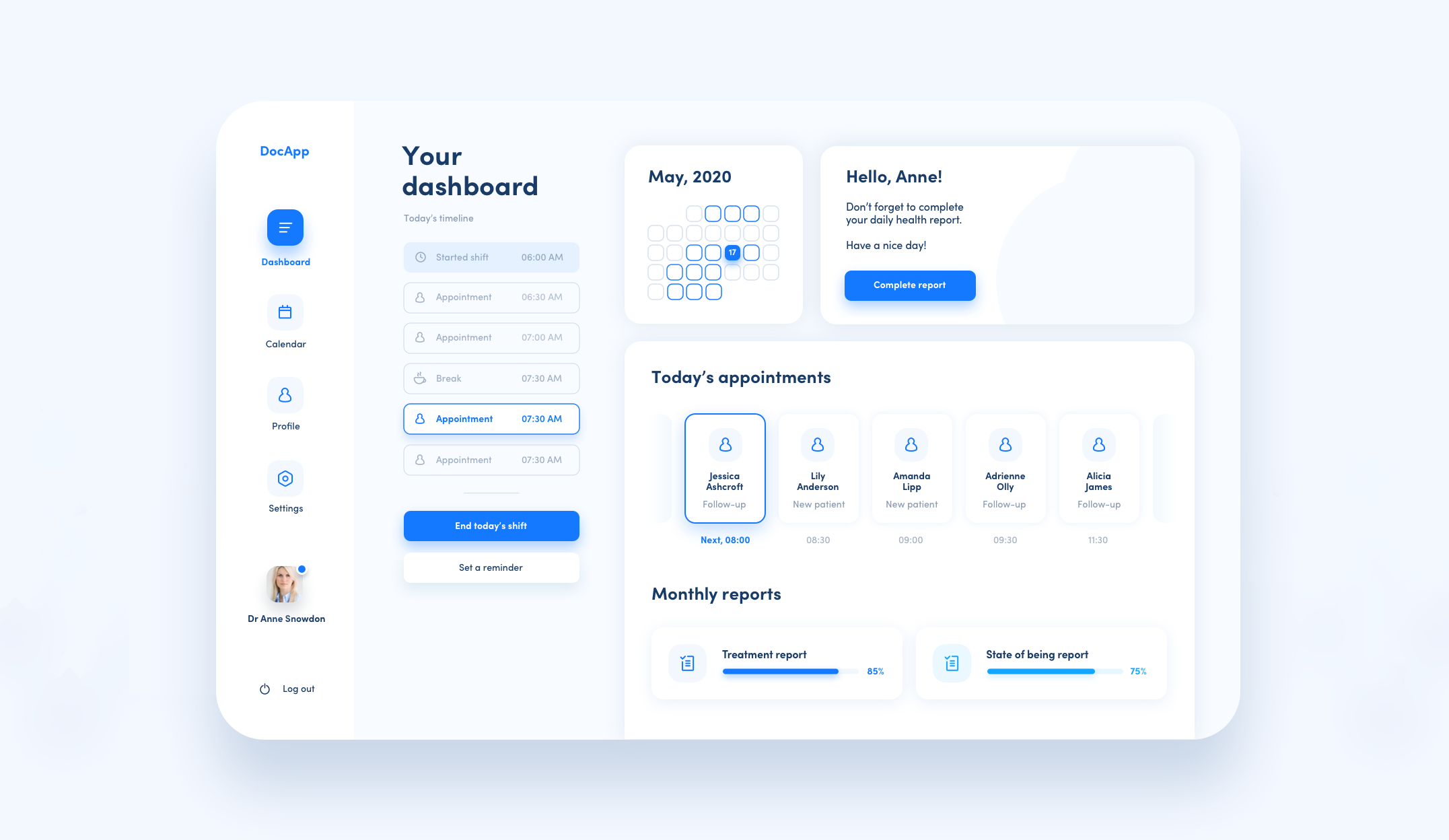

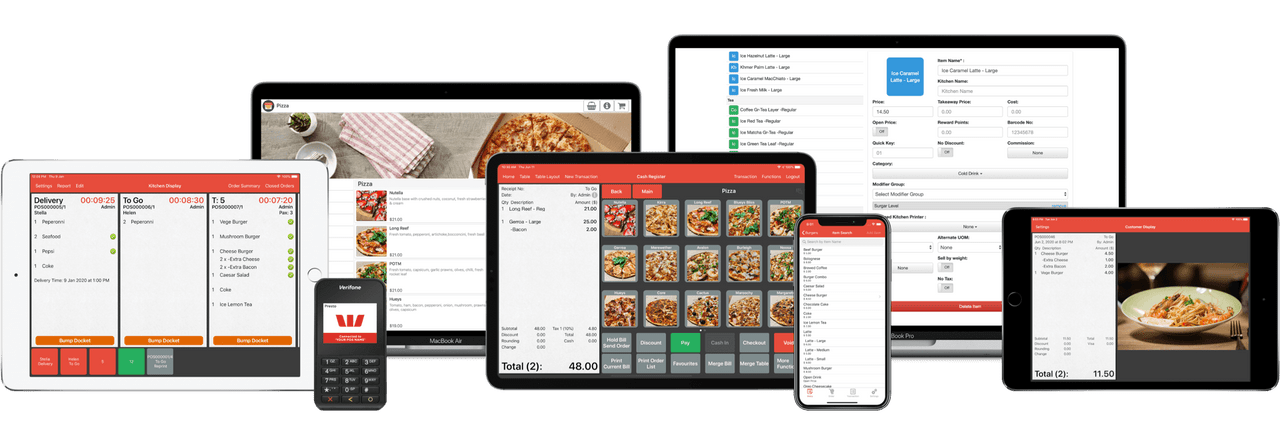

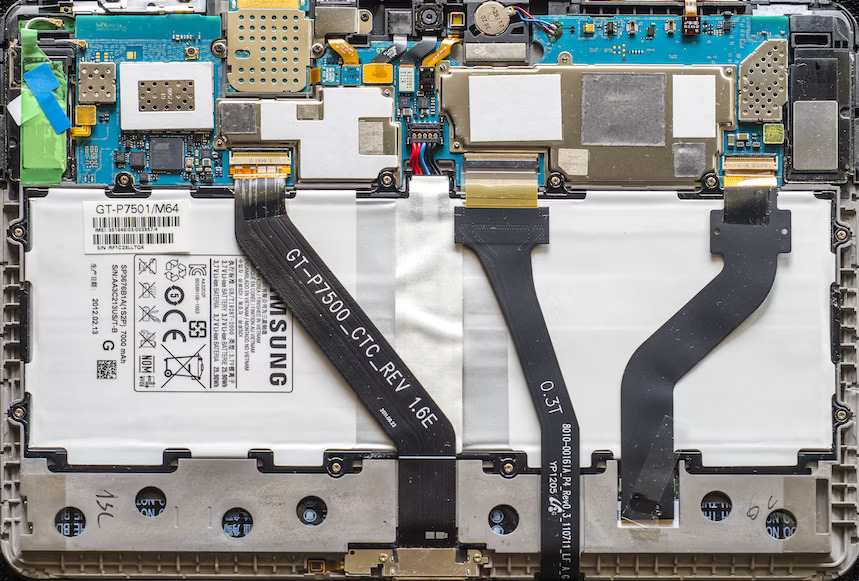

10. Technology Integration: – Modern technology is essential for food delivery, online ordering, and kitchen management. Loans can finance the integration of technology solutions into your food business.

11. Sustainability Initiatives: – As consumer demand for sustainable and ethically sourced food grows, loans can be used to implement sustainable practices, such as composting, energy-efficient equipment, and eco-friendly packaging.

12. Food Trucks and Mobile Catering: – Entrepreneurs in mobile food businesses can use loans to purchase or upgrade food trucks, trailers, or mobile kitchens.

13. Wholesale Distribution: – Food producers looking to expand their distribution network can use loans to enter wholesale markets or secure contracts with grocery stores and restaurants.

14. Inventory Management Software: – Efficient inventory management is crucial in the food industry. Loans can cover the cost of implementing inventory tracking and management software.

15. Food Innovation and Recipe Development: – Loans can finance research and development efforts to create innovative food products or refine existing recipes to meet changing consumer preferences.

16. Compliance with Regulations: – Ensure your food business complies with health and safety regulations. Loans can support facility upgrades and staff training to meet these standards.

When considering business loans for food entrepreneurship, follow these steps:

1. Business Plan:

- Develop a comprehensive business plan that outlines your goals, target market, revenue projections, and how the loan will be used to achieve them.

2. Loan Selection:

- Explore various business loan options, including term loans, lines of credit, or industry-specific loans, to find the one that aligns best with your food business needs.

3. Financial Management:

- Practice sound financial management to ensure that borrowed funds are used efficiently and that you can meet your loan repayment obligations.

4. Compliance and Food Safety:

- Invest in robust food safety measures and ensure compliance with all applicable regulations to protect the health of your customers and the reputation of your business.

5. Sustainability Practices:

- If sustainability is a focus for your food business, clearly communicate your eco-friendly initiatives to attract environmentally conscious consumers.

Business loans for food entrepreneurs are a recipe for success in an industry that demands creativity, adaptability, and quality. With strategic financing, food entrepreneurs can bring their culinary dreams to life, delight customers, and contribute to the vibrant and diverse world of food. From farm to table, these loans play a vital role in nurturing culinary innovation and culinary businesses.

![Building Brilliance: Unveiling the Premier Residential Construction Experts in [Your City]](https://readingcoremag.net/wp-content/uploads/2023/12/Depositphotos_26374913_m-2015.jpg)

0